|

|

|

|

|

|

|

|

|

|||

|

|

|

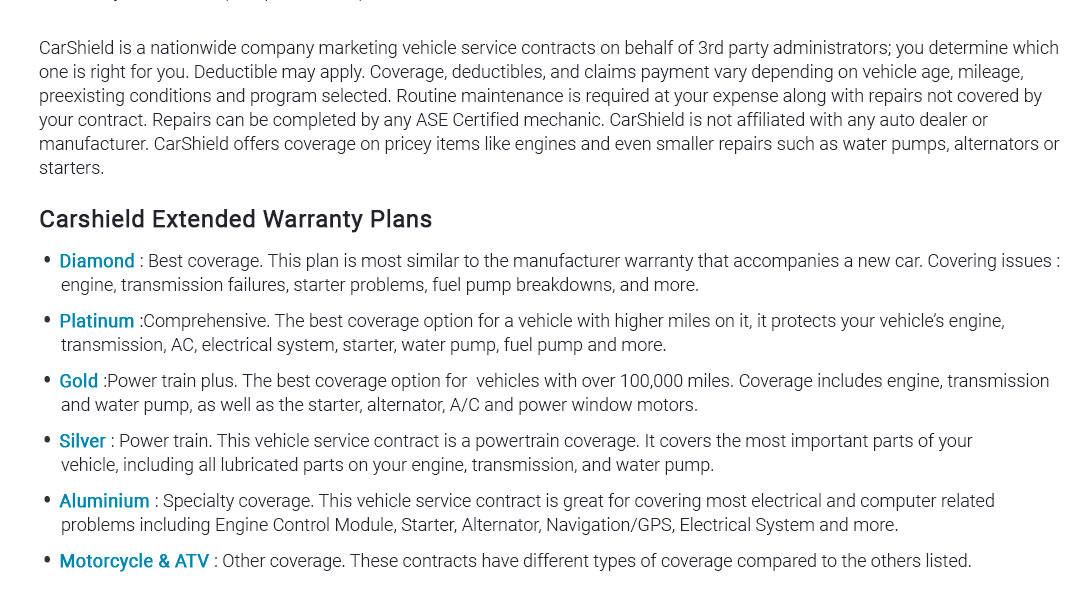

|||||||

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

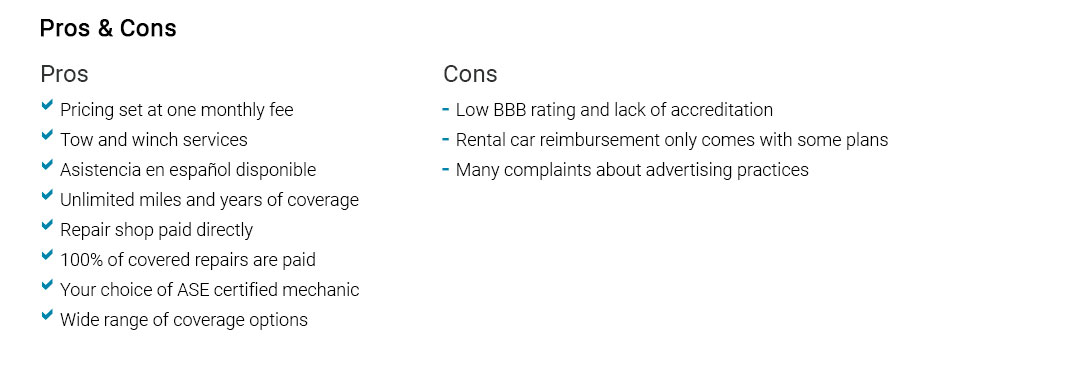

||||||

|

||||||

|

||||||

|

||||||

|

|

|

|

|

|

|

|

gap auto coverage decisions made clearWhat it is and when it helpsGap auto coverage pays the difference between your loan or lease payoff and your car's actual cash value (ACV) after a covered total loss, like a serious crash or unrecovered theft. Your primary auto policy pays ACV; gap can bridge the shortfall so you're not writing a check to the lender for a car you can't drive. It doesn't fix cars, and it doesn't add value - its job is to prevent leftover debt. Real-world moment: I slid on wet leaves into a guardrail and the adjuster totaled my three-year-old hatchback. ACV came in lower than my payoff because I'd put little down and the model depreciated fast. Gap picked up the remaining balance so the loan closed cleanly - useful, but it didn't give me money toward the next car. Who likely benefits

Who probably doesn't need it

Key pitfalls and fine print

Cost and where to buyDealers often sell gap as a single premium rolled into the loan - convenient but frequently pricier. Lenders/credit unions and auto insurers typically offer lower-cost versions as a monthly or annual add-on. Prices vary widely by state, lender, and vehicle; compare before signing. The cheapest option isn't always best if coverage limits are narrow. Checklist to compare

How claims usually flow

Practical next stepsEstimate your current equity by comparing your loan payoff to reputable ACV sources. If you're upside down - or close - price gap from your insurer and lender before considering a dealer product. Recheck after big payments or market shifts; cancel once you're consistently above water. It won't solve every money problem, but used correctly, it cleanly removes one expensive, poorly timed risk. https://www.bankrate.com/insurance/car/gap-insurance/

Gap insurance is a car insurance endorsement that covers the gap between the amount owed on a vehicle and its actual cash value (ACV) https://www.thehartford.com/aarp/car-insurance/gap-insurance

Gap insurance is an optional car insurance coverage that helps pay the difference between your car's Actual Cash Value (ACV) and the amount you owe on the loan. https://www.dfs.ny.gov/consumers/auto_insurance/gap_and_umbrella_policies

Gap coverage pays this amount in the event of a total loss. Currently, you can purchase a "waiver" of the gap amount directly from the lender or dealer, who in ...

|